This article is part of a larger series on Starting a Business.

An LLC operating agreement is a binding contract between members describing how profits and losses are shared and whether your LLC is member- or manager-managed. It serves to resolve member disputes, dictate responsibilities and more. Operating agreements aren’t always required by law but have an attorney or legal service draft one to include in filing documents.

Rocket Lawyer is a good alternative to hiring an attorney to help you make legal decisions for your LLC. If you want to save money on hourly attorney fees, check out Rocket Lawyer. You can get access to operating agreement templates, document review and attorney consultations for $39.99 per month. Try it free for 7 days.

This free operating agreement template includes eight articles with all of the information necessary to outline your LLC’s ownership and member duties. Important sections include your company’s management and tax structure, dispute resolution terms and other information to guide operation of your company. Use these free LLC operating agreement templates to clarify the organization of your LLC and retain control over LLC management, taxation, profit sharing and more.

LLC members are the people with a legal ownership interest in your company. LLCs can have one or several members, and the format of your LLC operating agreement depends on this distinction. Identify your LLC’s members in the Articles of Organization you file with your state and make sure your operating agreement reflects that structure accurately.

A single-member LLC is an LLC where one individual or entity owns 100 percent of the company. Operating agreements are most helpful in avoiding disputes between multiple members, but an agreement can provide benefits to a single-member LLC by overriding state default rules for how the LLC will be governed in the absence of an agreement. However, if you default you’ll have to comply with state-specific default rules regarding management and member authority.

In addition to avoiding the uncertainty of default rules, having an operating agreement will help cement your limited liability status by separating your LLC from you as an individual. One of the hallmarks of an LLC is that its members are not personally liable for the debts and other obligations of the company. However, in the absence of an operating agreement, your LLC may look more like a sole proprietorship than a company with limited liability status.

Use our single-member template if your company only has one member. Within the template, you’ll denote that your LLC is managed by you as a member or by a third-party manager. Choose the template language that best suits your LLC’s structure.

Operating agreements are most helpful for multi-member LLCs because they set forth the ownership, management and voting structure of your company. The legally binding document reduces the potential for disputes between members by establishing each member’s authority and clarifying voting rights, profit sharing and what will happen if a member decides to leave the company.

We recommend having an operating agreement for your multi-member LLC to avoid disputes between members and provide for quick, predictable resolution in the case a dispute arises. Establish the capital contributions of each member, identify voting rights and define what will happen if a member leaves the company.

Use our multi-member template if your LLC has two or more members. A multi-member LLC is one with multiple owners. Within the template, you’ll denote that your LLC is managed by a member, a group of members or a third-party manager. Choose the template language that best suits your LLC’s structure.

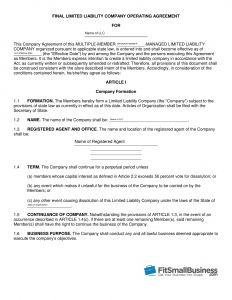

Screenshot of LLC Operating Agreement Template Intro.

For more information, check out our article describing LLCs and how to file for one. If you’re ready to organize your LLC with the state, check out our guide to filing for an LLC with your secretary of state.

FREE Ebook: How To Start Your Business Step-by-step blueprint that shows you how to go from idea to launch in 30 days This email address is invalid.Download My Ebook

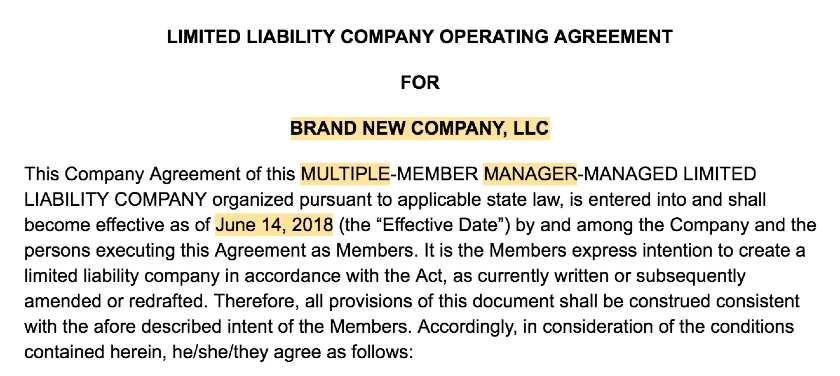

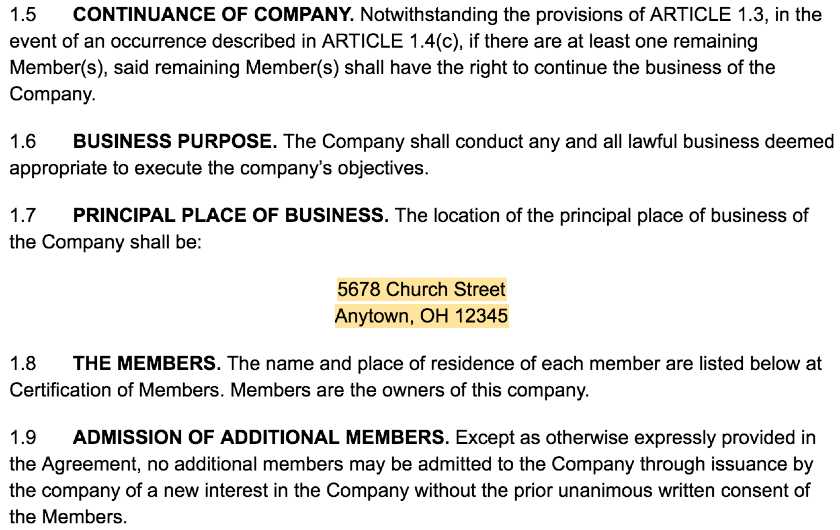

FREE Ebook: How To Start Your Business This email address is invalid. Email Download My EbookOnce you determine your ownership and management structure, organize the details of your LLC. The purpose of Article I is to describe your LLC, so include things like your name, primary address and registered agent. Include specific details in Article I of your eight-article operating agreement to properly identify your company.

Important terms to include in Article I of your operating agreement are:

Screenshot of LLC Operating Agreement Template Article I.

Screenshot of LLC Operating Agreement Template Article I.

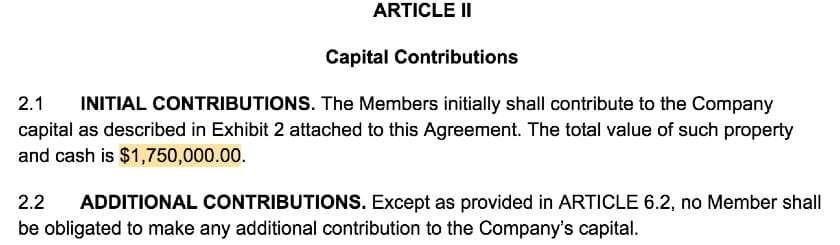

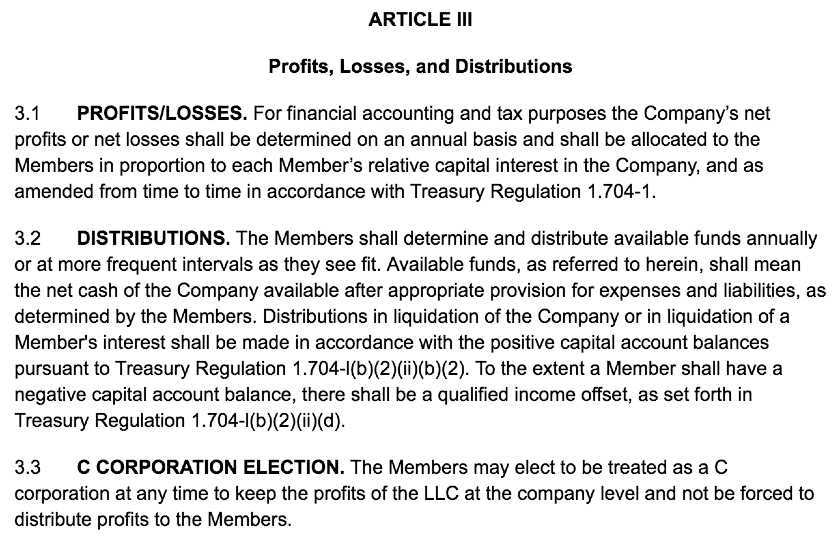

Initial contributions are the cash or property each member contributes to the LLC at formation. Record each member’s contribution in the operating agreement and, where appropriate, identify their percentage of ownership in the company. Generally, describe the total contributions in Article II of your operating agreement and list the detailed contributions in an exhibit.

Screenshot of LLC Operating Agreement Template Article II.

Generally, initial contributions are in exchange for a portion of ownership in the company. A contribution in exchange for ownership is called a capital interest and is typically equal to the percentage of the company a member owns. To complete this portion of the operating agreement accurately, include the total amount of each member’s contribution and details about how it’s allocated in an exhibit.

Screenshot of LLC Operating Agreement Template Exhibit 2.

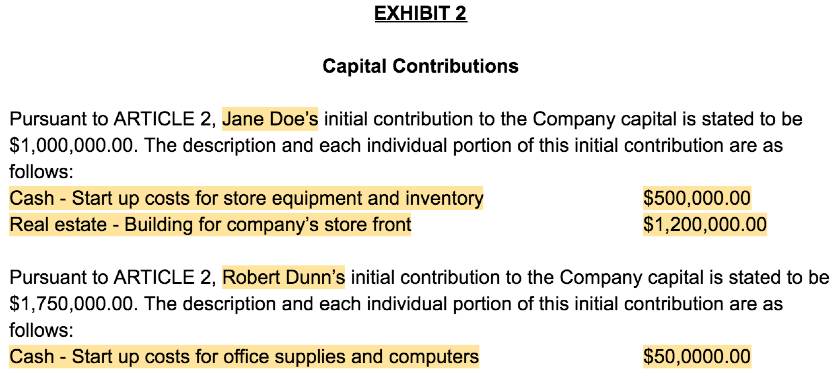

Article III details how profits and losses will be shared among members. Generally, profit allocation in a multi-member LLC is determined based on each member’s ownership percentage as identified in Exhibit 1 of your operating agreement. However, operating agreements give you the flexibility to change percentages and determine when profits will be distributed to the members.

A company’s profits and losses are the money raised and lost in a given year. These amounts can be shared between LLC members depending on their ownership interest or other factors identified in your operating agreement. Document how profits and losses will be shared in your operating agreement in case anyone’s financial responsibilities are questioned.

As the sole member of an LLC, you’ll receive 100 percent of profits and bear 100 percent of losses. However, with a multi-member LLC, it’s more important to detail the sharing of profits and losses in your operating agreement. List members in the agreement and identify their portions of profits and losses, making sure that everything adds up to 100 percent. Generally, percentages align with each member’s ownership interest in the LLC, but you can choose any numbers if your members agree.

LLC members don’t receive a salary for the work they do for the company. Instead, they receive distributions based on the company’s profits and losses. Use your LLC’s operating agreement to determine if your members will receive distributions quarterly, annually or at another frequency that makes sense for your company.

If you want to keep a flexible distribution schedule, include language in Article III of your operating agreement specifying that available funds should be determined and distributed annually or at more frequent intervals as the members see fit. Be sure to have your distribution schedule reviewed by a certified public accountant or tax attorney to make sure you’re meeting IRS regulations and filing the necessary forms.

The default LLC tax structure is that of a sole proprietorship or partnership. However, under certain circumstances, you can change your tax structure to that of a C corporation or S corporation by filing with the IRS. Whether you’ve already filed your LLC with the state or are planning to organize in the future, include the appropriate language in Article III of your operating agreement.

In general, the ways an LLC may be taxed include:

If you think you may want your LLC to be taxed as a corporation in the future, include language in Article III of your operating agreement to give yourself this option. Do this by stating that members may elect to be treated as a C corporation at any time.

The differences between LLC tax structure are very nuanced, so consult with a tax professional to help you decide what’s best for your company.

Screenshot of LLC Operating Agreement Template Article III.

The majority of management-related language goes in Article IV of your operating agreement and depends on how your LLC is managed. In member-managed LLCs, all of the members can make decisions; manager-managed LLCs restrict management to managing members or a third-party manager. Include language specific to your management structure in Article IV of your operating agreement.

The two LLC management structures include:

A member-managed LLC gives every member authority to bind the company. Under this structure, all of your company’s owners can open bank accounts, sign contracts and make other decisions that bind the company. Choose this structure if you’re comfortable with all of your LLC’s members playing a role in the day-to-day management of the company.

If you have a single-member managed LLC, Article IV of your operating agreement will be brief. This section should state the member’s powers, that the member will manage the LLC, and that the member has powers to sign contracts, set up bank accounts and otherwise bind the company. Also, include language affirming that the member’s liability is limited pursuant to applicable law. Finally, include boilerplate language for administrative matters as detailed below.

If you have a multi-member managed LLC, the management section of the operating agreement should include terms detailing member duties, dispute resolution between members and accommodation of members who wish to sell or otherwise transfer their interest in the company.

If you choose a member-managed structure and have multiple members include these terms before the management terms below:

In a manager-managed LLC, only managers and designated officers have the authority to bind the LLC. A manager can be a group of members with management authority or a third-party hired to manage the company. Choose this if you’d like to limit management authority to a group of your members or if your business will benefit from a non-member manager.

Generally, the manager-managed structure is best for larger companies, and member-management is better suited to single-member LLCs. However, it may be appropriate to consider a manager-managed single-member LLC if you own a retail business or other company that will necessitate hiring individual store managers. Consider the needs of your business and determine the appropriate management structure accordingly.

If you opt for a manager-managed structure, the management portion of your operating agreement won’t depend on how many owners you have. Instead, the operating agreement should include a section specifically outlining the duties of the manager.

If you choose a manager-managed structure include these terms before the management sections below:

Screenshot of LLC Operating Agreement Template Article IV.

Screenshot of LLC Operating Agreement Template Article IV.

Choosing a management structure is one of the most important parts of setting up your business. Your management structure will also determine the content of your LLC operating agreement, so it’s important to select the correct structure. Rocket Lawyer’s nationwide team of On Call attorneys can help you choose a management structure and draft an operating agreement for your LLC.

Regardless of your management structure, there is specific boilerplate language you should include in Article IV to protect your LLC and its members from third-party legal action, bankruptcy or regulatory action. If you have a multi-member LLC, include language regarding indemnification, recordkeeping requirements and how members can access company records in Article IV of your operating agreement.

Additional sections to include in your operating agreement include:

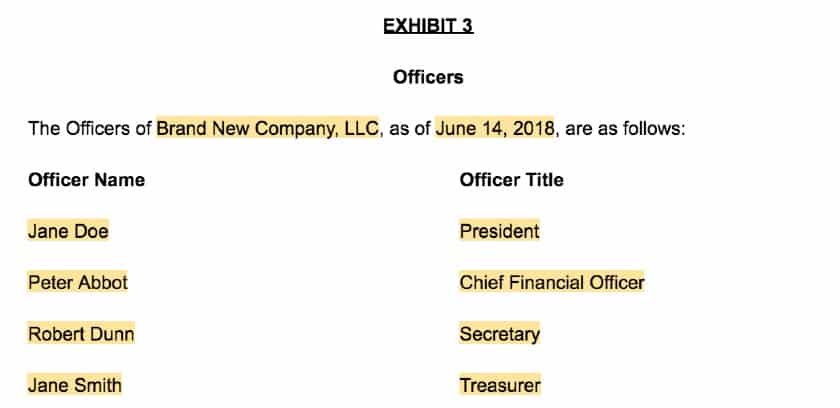

Your LLC isn’t required to have officers. However, you can provide structure to your LLC by creating titles and detailing relevant scopes of work. If your LLC has members or employees who’ll take a leadership role in the company, use Article V of your operating agreement to identify what they’ll do and how they’ll be selected.

Screenshot of LLC Operating Agreement Template Article V.

Include officer language in your LLC operating agreement if you may want officers including:

Screenshot of LLC Operating Agreement Template Article V.

In addition to describing each of the roles, include sections in Article V about general duties, how officers will be appointed, the extent of their decision-making authority, how they’ll be compensated, and how the LLC will fill open officer positions. You should also create an exhibit to the operating agreement that lists the names and roles of each officer at the time the agreement is executed.

Screenshot of LLC Operating Agreement Template Exhibit 3.

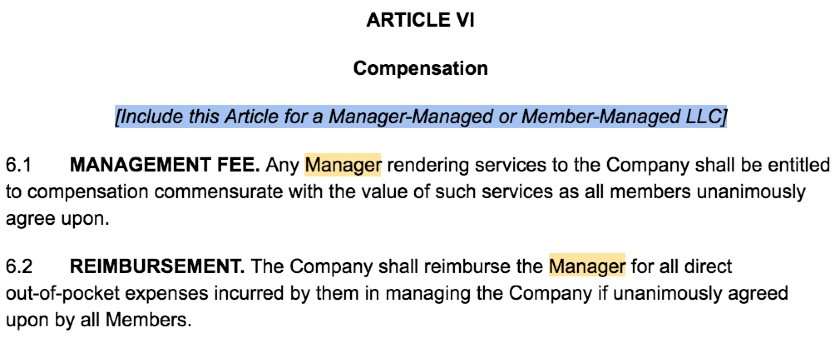

An LLC’s compensation structure determines what managers will be paid and how members can draw against their ownership interest. Use Article VI of your operating agreement to restrict when a member may take draws and how managers will be compensated for services. You don’t have to restrict member draws but always provide information regarding manager compensation.

LLC managers are typically reimbursed for out-of-pocket expenses related to LLC management and compensated for time spent performing LLC management responsibilities. If you would like to control how your LLC’s managers are compensated, include language in Article VI of your operating agreement that limits payment to reimbursement and compensation commensurate with the value of management services.

Instead of being compensated for their work in the company, LLC members have a capital account. However, in addition to receiving distributions, they can opt to receive a “draw” of funds from their capital account. Include language in your operating agreement to specify when and how draws may be made.

Screenshot of LLC Operating Agreement Template Article VI.

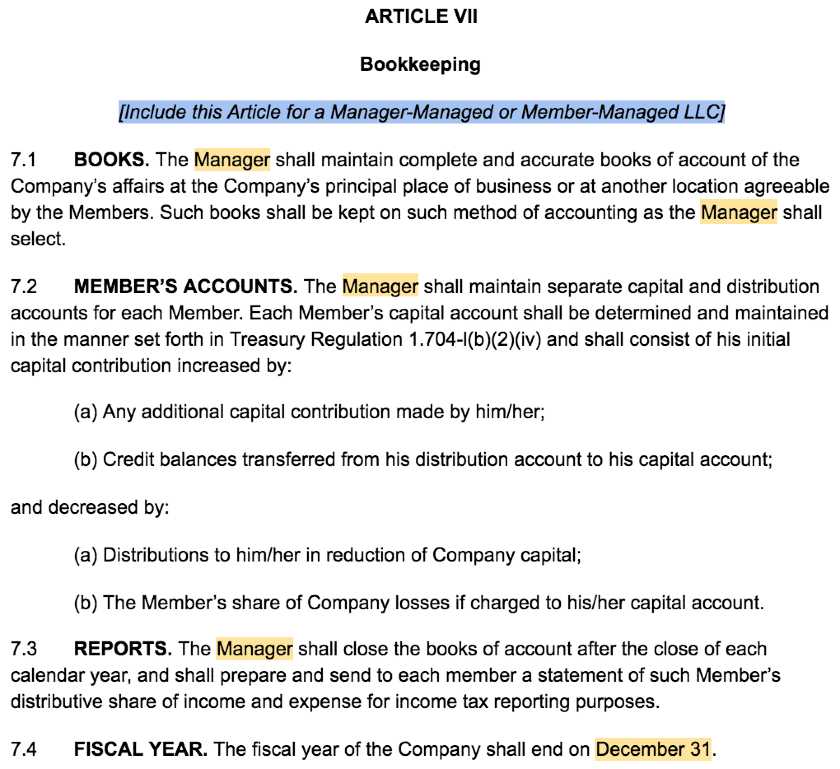

Your LLC should maintain detailed financial records to meet state and federal tax requirements. If you’re a multi-member LLC, you’ll also need to keep records of capital contributions and member accounts. Choose a fiscal year and use Article VII of your operating agreement to detail how to prepare and maintain your books and track member accounts.

An LLC’s books are used to track the company’s day-to-day affairs and prepare balance sheets and other financial statements. Keep complete records in your company’s ledger to track income expenses, loans and other debt. Include general language in your operating agreement to require that members or managers maintain complete and accurate books.

You should also keep a record of members’ capital account and distributions. Bookkeeping requirements for member accounts are dictated by federal regulations, so reference these to ensure you’re including the necessary details in your operating agreement. Incorporating these terms will help your LLC comply with tax requirements and prepare you if the LLC is sold.

After the close of each fiscal year, your LLC must also prepare statements of each member’s share of profits and losses and provide them for their individual tax returns. Include a section describing these requirements in your operating agreement to ensure your members and/or managers are aware of the reporting requirements.

Unlike a calendar year, an LLC’s fiscal year is 12 consecutive months ending on the last day of any month. This date determines when your year ends for accounting purposes. Choose a fiscal year that works for you, but you must continue this timeline every year, and it can be difficult to change.

Screenshot of LLC Operating Agreement Template Article VII.

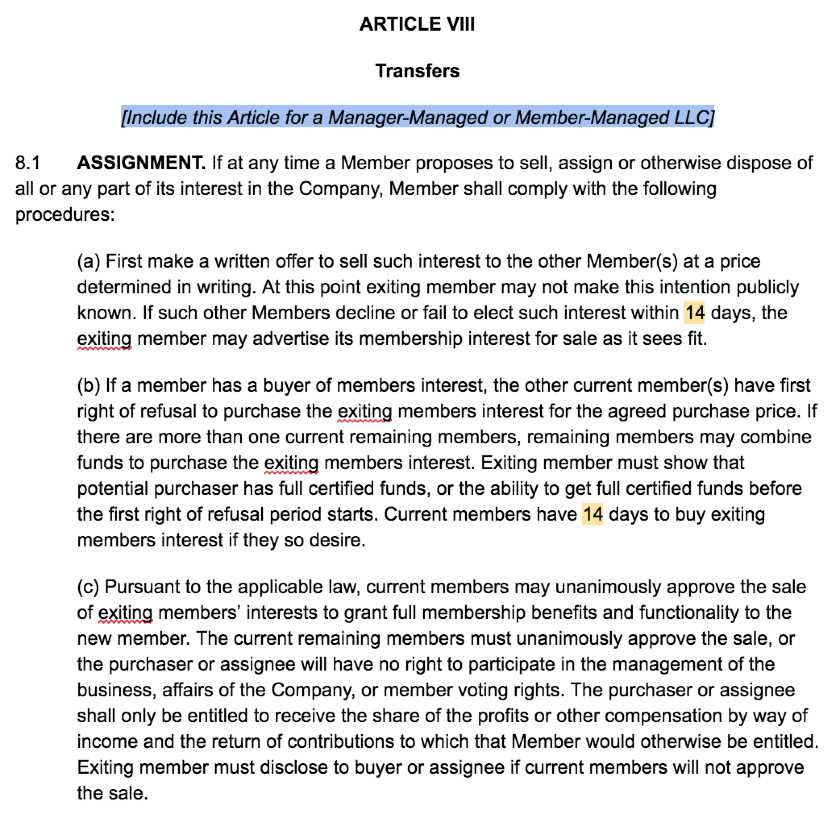

Article VIII of your operating agreement should include procedures for transfer of shares in case of a member buyout or the company’s dissolution. Buyouts involve members selling their ownership shares, whereas dissolution occurs when an LLC goes out of business. Control how membership shares are treated in these situations by describing procedures in your agreement.

Use Article VIII of your operating agreement to describe how shares will be assigned from an exiting member, how an exiting member’s interest will be valued for the purpose of a transfer and how the member’s interest will be distributed and reimbursed. Much of this language is boilerplate, but it’s important to describe how long members will have to purchase an exiting member’s interest and what happens to a former member’s debts upon dissolution of the company.

Screenshot of LLC Operating Agreement Template Article VIII.

To make an operating agreement a binding contract between members and/or managers, it must be signed by every member of your LLC. Once signed, provide copies to each member and manager and keep the original on file at your principal place of business. Always check with your secretary of state regarding specific filing or recordkeeping requirements.

Screenshot of LLC Operating Agreement Template Certificate of Formation.

An operating agreement is a legal contract among members and between members and managers of an LLC. Operating agreements provide stability to LLCs by formalizing ownership shares, profit-sharing, voting rights and other parts of the business. Once signed by all of the LLC’s members, it becomes a legally binding contract defining how the company should operate.

Defining important terms of your company’s operating will help your LLC survive if disputes arise or a member chooses to leave the company. An LLC operating agreement also enables companies to avoid the default rules states impose on companies that don’t have an agreement on file. Include all of the relevant information in your operating agreement so you can find it easily if a problem arises.

In the absence of state requirements, operating agreements are best for multi-member LLCs or LLCs with employees. However, your LLC will be subject to default state laws if you don’t have an operating agreement on file, so we recommend that every LLC have one in place. It’s best to hire an attorney to assist with important legal documents, but you can save money by using our templates to draft a simple LLC operating agreement for your company.

States don’t require LLCs to file operating agreements with the state formally, but some require LLCs to keep one on file. Even if your state doesn’t require an agreement, the document is a great way for any LLC to formalize operations. Check with your secretary of state to determine if you’re required to have an operating agreement.

“Issues with third parties are part of business — business conflicts happen and you deal with them. What tears a business apart is when it implodes from the middle. If members are fighting over profit sharing arrangements or other major decisions, an operating agreement can protect you from another member destroying your business.” — Brett Trembly, Esq., Trembly Law Firm

There are pros and cons to having an operating agreement for your LLC. Because you aren’t required to file an agreement in every state, decide whether drafting one is worth the added costs. If you have the time and resources, execute an operating agreement to formalize important elements of your business and avoid state-specific default rules.

The pros of using an operating agreement include:

The cons of using an operating agreement include:

The format and content of an LLC operating agreement change depending on the LLC structure and state of organization. In addition to checking with your state’s requirements, follow a standard format to ensure your agreement is comprehensive and understandable. Use our simple LLC operating agreement templates to create an agreement that meets your LLC’s needs.

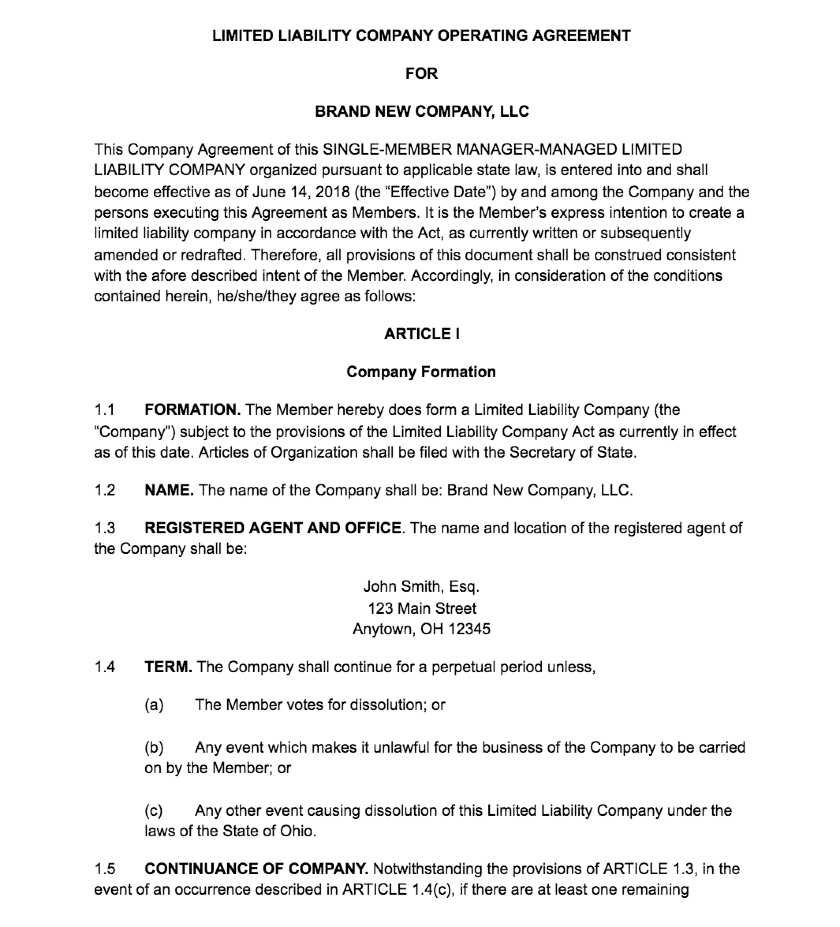

Single-member LLC operating agreements serve to separate the member from the LLC for liability purposes and supersede state default rules. They are also an excellent way to establish the duties and compensation of a third-party manager. Select this template for your single-member LLC and choose the language appropriate for your management structure.

Check out our simple single-member LLC operating agreement below:

Screenshot of Single-Member LLC Operating Agreement.

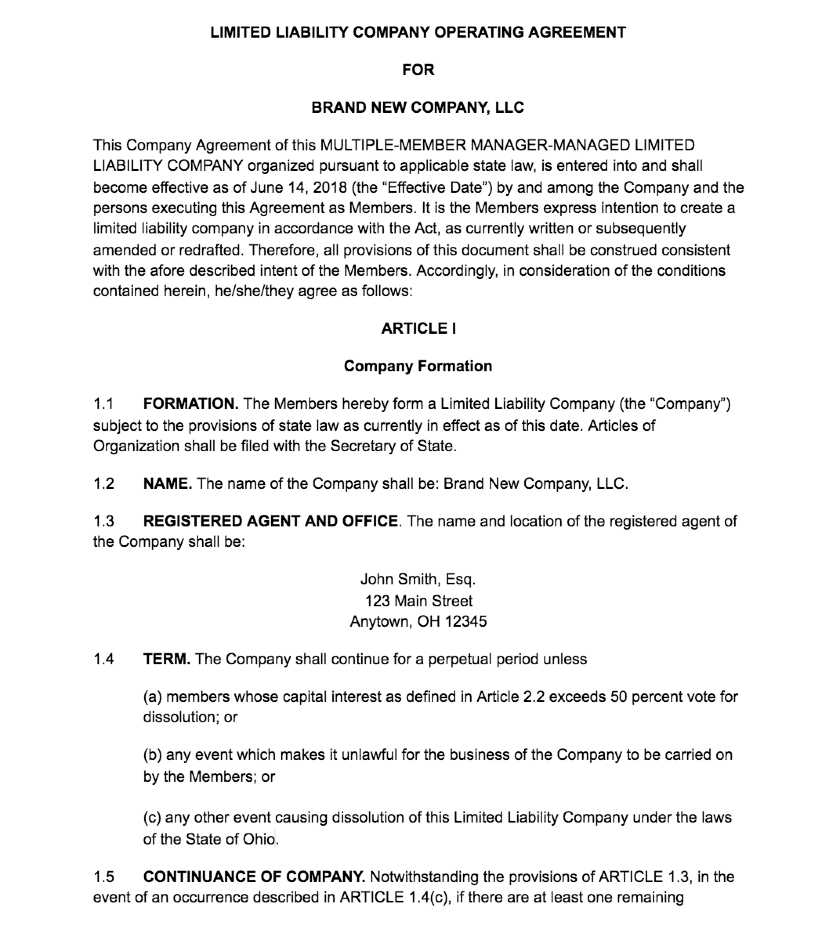

An operating agreement for a multi-member LLC includes many of the same terms as a single-member operating agreement, like primary place of business and registered agent. However, this template is more detailed than the single-member template because it’s aimed at making interactions between members more predictable.

Check out our multi-member LLC operating agreement below:

Screenshot of Multi-Member LLC Operating Agreement.